Drip-a Proven Approach to Wealth Building

What Are DRIPS?

Direct stock and dividend reinvestment plans, or to use the acronym, DRIP's have been around for some eighty (80) years. As the name suggests, they permit investors to directly invest in any a significant number of public companies without going through a stockbroker. Investors are able to buy stocks directly from the companies, or via a transfer agent. In general, the purchase would entail a modest down payment coupled with automatic monthly payments. The term "IRM 72's" is also used to describe DRIPs. The two names are one in the same and should not be viewed as different investment vehicles.

WEALTH BUILDING OVER TIME

As aforementioned, DRIP's maybe referred to as IRM 72's as well. They are an efficient and effective mechanism for building substantial financial nest-eggs over time. They are efficient investment vehicles because they allow investors to pay a small investment fee, usually for administrative purposes, while investing substantially more of their money in a particular stock. In some cases, a number of companies will cover some of the administrative fees, especially ones involving reinvestment of dividends, associated with DRIP investing. It is a fact that even discount brokers cannot match the low costs associated with DRIP investing. Furthermore, greater efficiency is realized with DRIPs due to "dollar cost average" associated with purchasing risk assets (stocks) over time. In a nutshell, investors are able to acquire more of a particular stock when the market price declines, but less when the price increases. However, over the extended period of time, the actual costs averages out.

It is an effective mechanism because unlike investing lump sums of money and taking greater risk, DRIPs allow for gradual investing over time and investors tend not to feel the pain of the volatility that often arises from time to time in the market. Thus, DRIP investors are less likely to panic and pull money out of their DRIP portfolios whenever bad news hits the market and causes chaos and panic (i.e., the root cause of volatility in the stock market). DRIP investors tend to appreciate market dips because they view them as opportunities to pick up their stocks at bargained prices. Picking up the stocks at these bargained prices tend to add to DRIP investors capital appreciation whenever other investors return to the stock market and chase stocks to higher prices. This is merely one way in which DRIP investors make money on their investments, and the other way is in effect "icing on the cake".

DRIP investors experience icing on their investment cakes from the high dividend yields that they get from their investments. It is not inconceivable for DRIP stocks to give dividend yields as high sixteen (16%) percent. The yield is determined by taking the annual dividend and dividing it by current market price. Of course the higher the annual dividend, and the lower the current stock price, the greater the dividend yield. The opposite also is true. Most DRIP stock pay quarterly dividends, but several also pay monthly dividends which provide a higher effective yield to investors. Even if a DRIP stock does not increase in market price, if it has a high single or double digit yield that maybe enough for investors to maintain their positions in the stocks. Thus, it is a rarity to see many of these stocks decline in value. Investors tend to chase them for their dividend yields.

Investors chase these stocks for their dividend yields because these yields tend to fuel geometric growth in DRIP accounts, especially when an investor re-invests their dividends (i.e., use their dividends to buy additional shares of stocks). The re-investment of the dividends coupled with automatic monthly investment tend to bring about a profound compounding effect in the DRIP accounts. This effect can only be described as geometric in nature, and the value of the account tend to quickly double in most cases over a short period of time. Thus, the dividend yield of any DRIP stock is very important. The higher the yield the less time it takes for the DRIP account to grow geometrically.

DRIPs are the only investment vehicle that can create a greater wealth effect. No other investment (i.e., real estate or anything else) is more effective at creating wealth than investing in stocks. However, only forty nine (49%) of Americans are actively trading stocks (December 2014 Issue of "DRIP Investor"). Thus, 51% of Americans have their money tied up in other investment vehicles like real estate, or in most cases, institutions (i.e., banks or insurance companies). Thus, the wealth gap will continue to widen as long as a minority of Americans is invested in the stock market. Why? Again, the US Stock Market creates more millionaires and billionaires than any other investment institution. The stock market, in effect, provides an effective way in which US and other investors can not only stay abreast of inflation, but soundly beat inflation.

Unfortunately, the majority of Americans will not beat inflation. They will continue to receive negative real returns on their investments because many of them simply do not understand "time value of money". They are convinced that banks and insurance companies are the safest places for their money, despite the fact that banks in general pay as little as a 1/2 of one percent return on passbook savings, while insurance companies will pay about two point five (2.5) percent on their best financial vehicles (annuities). Treasury bonds yields are somewhere in between what a bank will pay on its passbook savings and certificate of deposit (COD) account. The dividend yield pickings are slight to none whenever investors look at alternative investments to the stock market. According to time value of money (future value of a lump sum and future value of an annuity), money will not grow well whenever simple interest is paid. Thus, banks and insurance companies are simply middlemen which must be cut out of the equation if an investor wants to realize geometric growth (compounding effect).

In most cases, the banks and insurance companies simply take the very dollars that investors entrust to them, and lend them out to other customers (in form of secured loans) at much higher rates. The banks in particular cannot directly invest depositors dollars into the US Stock Market, and they do have to maintain certain reserve balances in accordance with the Feds' guidelines and regulations. Nevertheless, these banks and insurance companies, collectively known as institutional investors, do move the Markets with the huge amount of dollars that they invest in stocks. They realize tremendous returns, but continue to pay nominal returns on their passbook savings and CODs. They get away with it because 51% of American investors fear investing their money in the stock market. They believe that their money is "safe" in a bank because the banks will claim that they are "FDIC" insured up to $250,000.00 per bank account. This insurance actually comes from the American Taxpayer who ultimately foots the bill for any failed commercial depository, or savings and loans. This was the case in 1989-1991 when the U.S. taxpayers bailed out the savings and loans industry. What the banks do not tell their customers is that they are actually getting negative real returns on their passbook savings and COD accounts. Why is that? If inflation is running at 2.5% in the U.S.,and the banks are merely paying a half (1/2) of one (1) percent, then it stands to reasons that most investors are losing purchasing power by keeping their money in a passbook savings or COD account.

A bank customer will not experience any degree of wealth by simply putting money in a passbook savings or COD account. As a matter of fact, given time value of money concepts, it would be better for a bank customer to keep their money under their mattress, given the negative returns that they experience by putting it in a passbook saving or COD account. The only real way to build any meaningful wealth over time is by investing directly into stocks. Stocks are risk assets, but given the fact that the US Stock Market is down roughly 20% to 25% of the time and up 75% to 80% of the time, it is a "no-brainer" for investors to stay in the stock market, especially if their investment time horizon is long-term (1-30 years). It is a fact that substantial wealth in the stock market can be built over time with consistent investing and reinvesting of dividends and capital gains. Unfortunately for the 51% of Americans who look to bank and insurance companies, the stock market is the only profitable game in town.

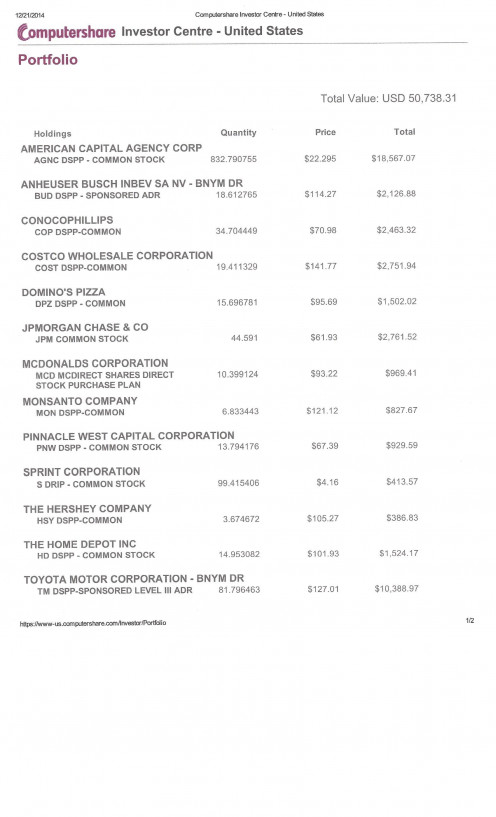

Anyone, even workers on minimum wages, can invest in the stock market via DRIP investing. This author started a DRIP portfolio back on November 1, 2012 with four stocks, AGNC, COP, COST, and TM (see below for details). The initial investment over the one year period amounted to $6,500.00. As of October 31, 2013, the DRIP Portfolio grew by five (5) additional stocks and had an accumulated market value of $13,078. The estimated return during the first year of investment was roughly 52.6%, most of the return came from the performance of Toyota Motor Corporation (TM), ConocoPhillips Corporation (COP) and JP Morgan Chase Bank (JPM) Over the next one year period that it grew to 15 stocks (AFLAC is not clearly shown in the depiction). Additional capital investment totaled $15,000, but most of the growth resulted from re-investment of dividends and capital gains. As of the close of the stock market on December 19th, 2014 the value of the author's DRIP Portfolio is $50,700 plus. By this time next year (i.e., December 20, 2015), the projected value of the Portfolio will be around $80,000 to $85,000, given that the same investment strategy will be maintained, and additional capital investment of $15,000 to 20,000 will be made in American Capital Agency Corporation (AGNC), which has an effective dividend yield of 11.5%, a net book value of $25.25.

Investing in the U.S. Stock Market, or any of the capital markets entails considerable risk. Any potential investor exposing their capital to these markets need to do their homework prior to buying risk assets. This homework may entail in depth consultation with financial and investment advisers prior to any funds being committed to risk assets. An investor should never under any circumstances expose capital to the markets if they cannot afford to lose said capital. A potential investor should never rely solely upon anything that is written in this article, or any other article as the only source of prudent investment advice and basis for any decision making. Again, a proper research and consultation coupled with professional investment advice from reliable source should govern any investment decisions, regardless of the amount of capital involved, or the investment strategy employed.

My DRIP Portfolio